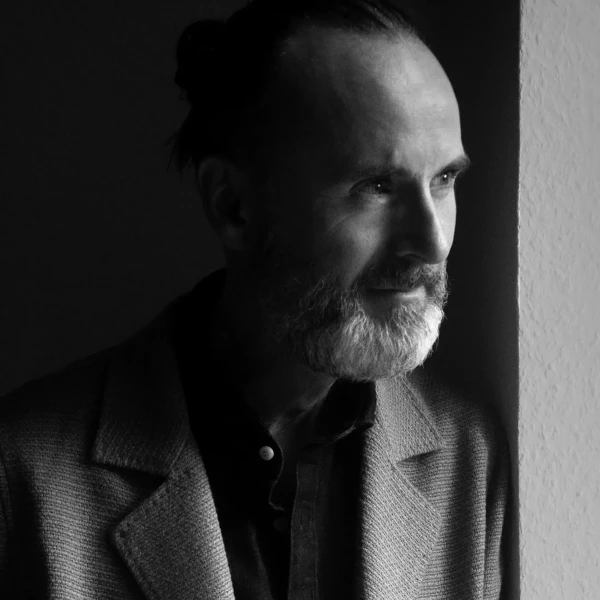

Mike Uhl

“I’m the one who stays — when others walk away.”

At five, I wanted to be a professional footballer.

At eighteen, I played for the East German junior national team —

until an injury ended the dream.

Early on, I learned:

life doesn’t follow plans.

Then came the fall of the Wall —

politically and personally.

I became a banker. Built a career.

Branch manager. Top advisor.

Advisor to the advisors.

The suit fit. The numbers added up.

But the higher I climbed,

the clearer it became:

I was no longer advising. I was selling.

And what was right for the client

rarely matched the bank’s bottom line.

So I pulled the plug.

And lost almost everything —

except my integrity.

I started over.

I travelled, researched, listened.

Spoke with thousands of investors.

And realised:

It’s not returns that matter.

It’s maturity.

The best investors don’t think in quarters —

they think in decades.

They don’t chase trends.

They follow themselves.

Today, I work with people

who are seeking clarity —

not products.

Who are ready to take responsibility —

not just grow their money.

I’m not the one who shows up

when everything is going well.

I’m the one who stays —

when others walk away.

Because in the end,

it’s not the wealth that endures —

but how you’ve stewarded it.